Not known Factual Statements About Jc Lee Realtor

Wiki Article

The Ultimate Guide To Jc Lee Realtor

Table of ContentsThe Only Guide for Jc Lee RealtorThe 4-Minute Rule for Jc Lee RealtorWhat Does Jc Lee Realtor Mean?Little Known Facts About Jc Lee Realtor.A Biased View of Jc Lee Realtor

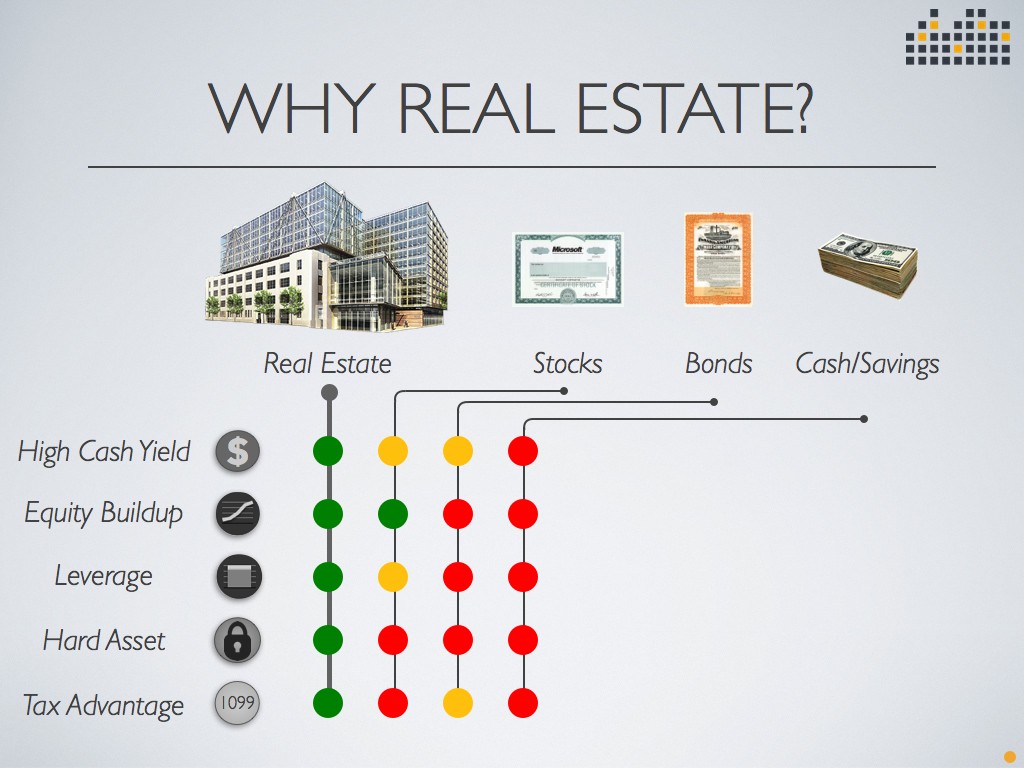

Property is normally a wonderful financial investment alternative. It can create ongoing passive earnings as well as can be a great lasting investment if the value raises over time. You might also use it as a part of your total strategy to begin building wide range. You require to make certain you are ready to start spending in real estate.Purchasing a home, apartment building, or tract can be expensive. That's and also the recurring upkeep expenses you'll be accountable for, in addition to the capacity for revenue spaces if you are in between renters for a while. Right here's what you need to understand about buying realty and if it's the appropriate option for you.

If you can not manage to pay cash for the residence, at the very the very least, you need to be able to manage the home mortgage settlements, even without rental revenue. You may also experience a time where you have no occupants at all for the residential or commercial property.

Jc Lee Realtor - Truths

Particularly if you do not have time to do everything that needs to be done at your residential or commercial property, making use of a company is a good option. You need to price your rental residential or commercial property to ensure that all of these costs and also other costs are completely covered. Furthermore, you need to take the first few months of excess cash and established it aside to cover the expense of repair services on the residential property.

You need to additionally be prepared to handle extra expenses and other scenarios as they arise, probably with a sinking fund for the residential or commercial property. Research Study the Property Very Carefully If you are buying land that you plan to cost a later date, you require to look into the land deed completely.

Likewise make sure there isn't a lien on the building. You may additionally intend to consider things like the comparables in the community, consisting of whether the location is up-and-coming, as well as other outside aspects that can impact the residential property worth. When you have actually done your research, you ought to be able to make the right choice about buying it as a financial investment.

How Jc Lee Realtor can Save You Time, Stress, and Money.

You might earn money on your financial investment, but you could lose cash too. Things might transform, and an area that you assumed this article could boost in worth may not in fact rise, as well as vice versa. Begin Small Some genuine estate capitalists start by buying a duplex or a house with a cellar apartment or condo, then staying in one device and also leasing the other.

Just how do you invest in real estate? You can take several paths to obtain started in genuine estate. One would be to buy a multi-unit residential or commercial property and also lease out the various other units.

You can also lease out spaces in your own home to accumulate the funds to purchase more real estate. REITs also enable you to buy realty, yet without having to conserve up the cash to purchase a residential property or preserve one.

Jc Lee Realtor Fundamentals Explained

You have plenty of options when it comes to purchasing property - jc lee realtor. You can buy a single-family house, lease it out as well as gather regular monthly rent checks while waiting on its value to increase high sufficient to generate a huge earnings when you offer. Or you can purchase a tiny strip shopping center and collect regular monthly rental fees from beauty parlor, pizza restaurants, cushion shops as well as various other organizations., brief for genuine estate financial investment trust funds, is one of the simplest methods to spend in actual estate. With a REIT, you spend in actual estate without having to stress concerning keeping or handling any type of physical buildings.

You can invest in a REIT just as you would certainly invest in a stock: REITs are provided on the major supply exchanges. The National Organization of Real Estate Financial investment Trusts claims that concerning 145 million United state residents are spent in REITs.

Some Ideas on Jc Lee Realtor You Should Know

You can after that either reside in the residential or commercial property or lease it out as Discover More Here you wait for it to value in worth. If you rent the residential or commercial property, you could be able to use these monthly checks to cover all or component of your regular monthly home loan payment - jc lee realtor. Once the home has valued enough in value, you can sell it for a large payday.You can lower the probabilities of a poor investment by researching local areas to discover those in which residence values tend to rise. You must likewise deal with actual estate representatives and various other experts that can you reveal historical recognition numbers for the communities you are targeting. You will certainly need to be conscious of area.

Report this wiki page